Posting G/L Transactions From a 3rd Party Payroll Service

Accounting transactions should be posted to EBMS to update the financial statements within EBMS. The financial transactions that must be processed after each payroll are as follows:

-

Credit the checking account for the amount paid to the workers or to the 3rd party payroll service: Crediting the bank account is necessary to reduce the checking account balance to cover the cost of payroll.

-

Credit the checking account for any tax payments: This step reduces the bank account.

-

Debit the Payroll Payable G/L account for ALL gross payroll costs: Do not expense the gross payroll accounts within EBMS since the expense accounts were debited when the time was entered into the EBMS software. See Processing 3rd Party Pay.

-

Debit the specific Tax Expense G/L account for all company tax liabilities: Note that worker taxes and other deductions are not included in the expense costs.

Importing 3rd Party Payroll Transactions into an EBMS Journal:

EBMS includes the tools to map the CSV file from the 3rd party payroll processor to the payroll journal entry import.

Complete the following steps to import labor accounting transactions from a file supplied by the 3rd party payroll processor:

-

Download the CSV file from your 3rd party payroll processor.

-

Open a new labor journal by selecting Labor > Journal Entry from the main EBMS menu.

-

Click the New button to open a new journal screen.

-

Select Process > Import detail from file… option from the labor journal menu: Review the Import Document Details documentation for detailed instructions.

-

Select the CSV file to import as shown below:

-

Process the journal to update accounting information. Review Creating Journal Entries for more details on creating and processing journals.

Manual Entry of 3rd Party Payroll Journal:

These accounting transactions can be entered within a payroll journal within EBMS manually using the information supplied by the 3rd party service. Complete the following steps to post the payroll transaction to the EBMS General Ledger system:

- Open a new payroll journal by selecting Labor > Journal Entry from the main EBMS menu.

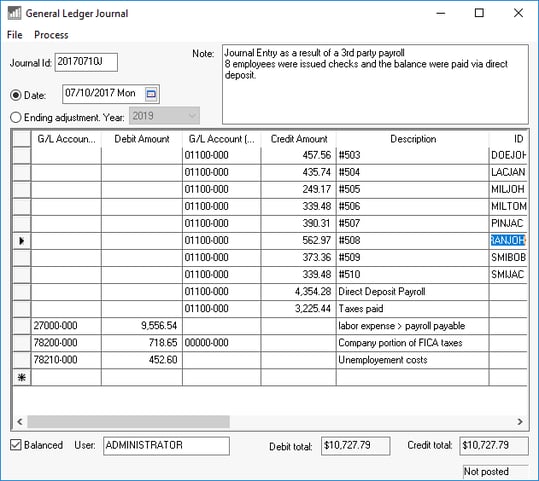

- Set the journal Date to the processing date from the payroll service.

- Enter any notes to the journal Note such as the payroll service and any other details.

- Enter journal detail lines for the gross pay as outlined below: Ignore the Employee ID and Reference2 entries if a single journal entry is entered, because pay is processed through the 3rd party rather than individual worker pay checks.

- Enter journal detail lines for each company tax payable. Ignore the Reference2, Payment Flag, Taxable Gross, and Gross Pay entries if the tax records do not exist within EBMS.

- Process the journal by selecting Process > Process from the journal menu.

Employee's gross pay transactions:

| Debit | Payroll Payable G/L Account |

| Credit | Checking G/L Account |

| Credit/Debit Amount | Gross Pay |

| Employee ID | Employee ID |

| Reference2 | Check No. |

| Payment Flag | N/A |

| Track1 | Work Weeks |

| Track2 | Bank G/L Account |

(Note that adjusting the gross pay within a journal will not add gross pay-by-pay-type in worker record Pay Tab > View Years. The gross pay totals by pay type cannot be adjusted since these totals are determined based on the pay date rather than the timecard detail date.)

Company Tax Transactions:

| Debit | Payroll Tax Expense G/L Account |

| Credit | Checking G/L Account |

| Credit/Debit Amount | Payroll Tax |

| Employee ID | Employee ID |

| Reference2 | Tax ID (optional) |

| Payment Flag | C (Company) (optional) |

| Track1 | Taxable Gross (optional) |

| Track2 | Gross Pay (optional) |

Review Creating Journal Entries for more information on entering and processing journals.