Processing 3rd Party Pay

The 3rd party pay process within EBMS will create an export CSV file for the 3rd party payroll service. The export file detail is shown at the end of this section.

This 3rd party process creates the expense transactions for all labor. EBMS uses an accrual payroll payable process that posts labor costs on the day the labor was performed rather than the cash method of posting the labor costs on the labor pay date. The gross labor costs are posted to the EBMS financial system using the individual timecard details lines. Note that this pay is credited to the Payroll Payable General Ledger account set within View > Advanced Options dialog from the timecard menu.

No cash or checking asset accounts are credited in this process since the 3rd party processes worker pay and manages worker deductions.

Process

Complete the following steps to process 3rd party payroll using the EBMS labor module:

-

Create a payroll period as described in Opening a New Pay Period. The Pay Period should reflect the last day of the payroll pay period and the Pay Date should equal the date the 3rd party payroll service processed the employee's pay.

-

Record the optional payroll clock in/clock out times using the various options within EBMS. Review Clock In/Out Overview for more details.

-

Enter timecard details using the various EBMS options listed below:

-

Tasks and Work Orders: Tasks Overview

-

Timecard Entry: Review Entering Timecards

-

-

Select Labor > Worker Payments from the main EBMS menu to open the Worker Payments dialog. Complete the following steps within this dialog:

-

Verify that the Payment Method for all employees listed is set to Payroll Service.

-

Click the Select All button to process labor for all employees listed.

-

Click on the Process button and select Calculate Taxes (Typical) option from the button menu. Note that this step may not calculate any taxes or deductions since the 3rd party service calculates payroll. The user can calculate and post company taxes or other deductions for non-payroll costs if desired.

-

Click on the Process button again and select Process Payments to process the daily debit transactions to individual work codes, jobs, etc. and credit to the Payroll Payable G/L account listed in the Advanced tab of each worker record. The process will create an export CSV file to export to the 3rd party payroll provider. Review the Process Worker Payments section for more details on this dialog.

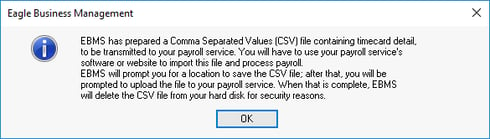

The following prompt will appear: "EBMS has prepared a Comma Separated Values (CSV) file containing timecard detail, to be transmitted to your payroll service. You will have to use your payroll service's software or website to import this file and process payroll. EBMS will prompt you for a location to save the CSV file; after that, you will be prompted to upload the file to your payroll service. When that is complete, EBMS will delete the CSV file from your hard disk for security reasons."

-

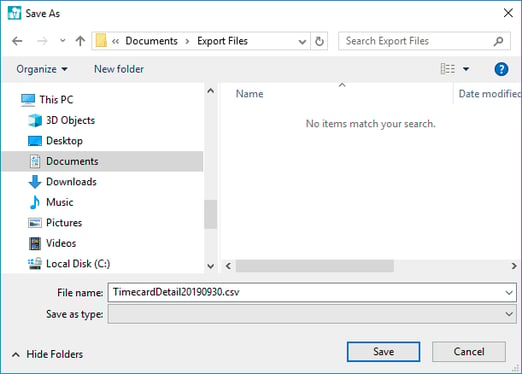

Click OK to open the Save As dialog as shown below:

-

Select a file location for the CSV export file.

-

Select the appropriate folder click Save. The File name will include a date to identify the specific pay period.

-

-

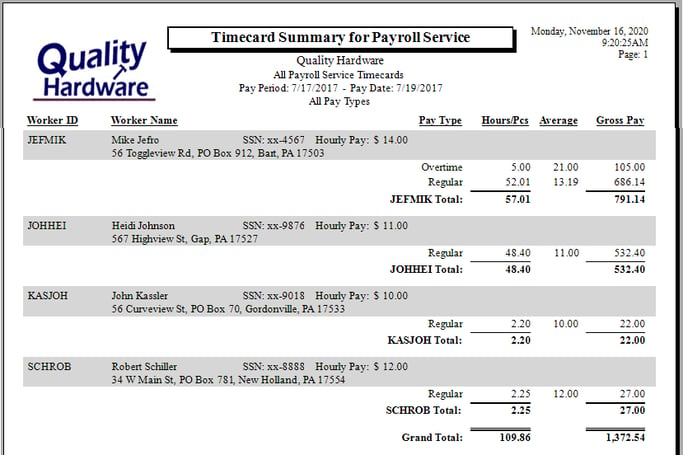

Print an optional report to list workers, hours, and pay for the pay period. Go to File > Reports > Labor > Time Cards > Timecard Summary for Payroll Service and double-click on the report name to open the Print and Report Options setup page.

Link this report to the report Print button on Worker Payments to make it more convenient. Review Print Buttons and Menus for report configuration steps. -

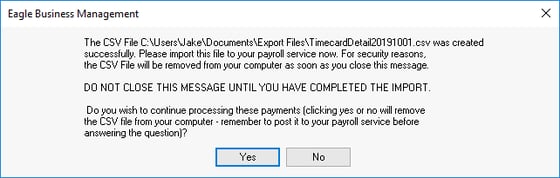

The following dialog will appear. Complete the next step: uploading to 3rd party provider, before clicking Yes.

This message will appear: "The CSV File [file address] was created successfully. Please import this file to your payroll service now. For security reasons, the CSV File will be removed from your computer as soon as you close this message. DO NOT CLOSE THIS MESSAGE UNTIL YOU HAVE COMPLETED THE IMPORT. Do you wish to continue processing these payments? (Clicking yes or no will remove the CSV file from your computer - remember to post it to your payroll service before answering the question.)"

-

Upload this CSV file to the 3rd party payroll provider. Contact the payroll provider for the steps to communicate the payroll file electronically. Send a sample CSV file to the provider to verify the file format. Click Yes on the dialog shown above after successfully uploading the payroll file.

-

The accounting transactions from your 3rd party payroll provider can be electronically imported into an EBMS journal. Complete the steps in the Posting G/L Transactions from a 3rd Party Payroll Service article when the payroll service has completed the payroll process for the current pay period.

-

Close the payroll period within EBMS. Review the Closing Payroll Periods section for more details on this step.

Export File information:

The file format is a comma separated values (CSV) with the field names shown on row 1. These files can be accessed by MS Excel.

The file headings or field names as shown below in yellow with the following format:

-

Field name

-

Field description: Some description hyperlinks link to more documentation

-

Format

-

Required or Optional

PAY_P YYYYMMDD* Required | PAY_P YYYYMMDD* Required | DATE Date labor worked YYYYMMDD* Required | PAY_DATE YYYYMMDD* Required | PAY_LEVEL 10 alphanumeric Required | WORK_CODE 10 alphanumeric Required | GL_CODE 5-3 numeric code Required | JOB_ID 10 alphanumeric Optional |

| HOLJOH | 20180505 | 20180430 | 20180509 | Regular | GEN | 75100-040 | CERN |

| JEFMIK | 20180505 | 20180502 | 20180509 | Regular | SRV | 74100-000 | HOUSE |

| SCHROB | 20180505 | 20180502 | 20180509 | Regular | SRV | 74100-000 | HOUSE |

| SCHROB | 20180505 | 20180503 | 20180509 | Holiday | HOL | 74810-000 |

JOBSTG_ID 15 alphanumeric Optional | HOURS Hours Worked 2 decimal number Required | HR_PAY Pay rate 2 decimal number Required | GROSS_PAY Gross pay 2 decimal number Required | BASE Required | TYPE Pay type see numeric table ^ Required | START_TIME Clock-in time HH:MM Optional | STOP_TIME Clock-out time HH:MM Optional |

DEV | 5.5 | 21.50 | 118.25 | 1 | 3 | 11:20 | 14:50 |

| ROOF | .75 | 12 | 9 | 1 | 3 | ||

| SCHROB | 2.0 | 16 | 32 | 1 | 3 | 8:00 | 10:00 |

E_DATE Timecard entry date YYYYMMDD * Required | LOCATION State/prov country Required | SEC_DEV Time tracking device 20 alphanumeric Required | SEC_USER tracking Windows user 20 alphanumeric Required | SEC_DATE Date & time of entry YYYY-MM-DD HH:MM:SS Required | PIPE_PHASE 24 alphanumeric Optional | PIPE_RANK 3 digit number Optional |

20180501 | PA USA | JOHNH-PC | JOHNH | 2018-05-01 16:54:18 | Assembly | 5 |

| 20180502 | AZ USA | JEFF | JEFF | 2018-05-02 12:25:05 | Soldering | 2 |

| 20180504 | PA USA | FRONTDESK | ROB | 2018-05-04 21:42:11 |

* YYYYMMDD: Standard file date format in EBMS is a 4-digit year, 2-digit month, and 2-digit day. Example: 20190801 = August 1st, 2019

^ Pay Type code list: See Pay Types section for details

0 = Benefit

1 = Employer Paid Tips

2 = Salary

3 = Standard

4 = Reimbursement

5 = Take Home Tips

6 = Benefit Salary

7 = Piecework