Customer Finance Charges

Finance terms, overdue charges, and monthly rates

The terms for finance charges (overdue charges) should be calculated before statements are printed. These overdue charges can be calculated at any time and as often as the user wishes without any adverse effects. The entire finance charge amount is recalculated for each invoice every time the finance charge process is launched. The recalculation process will correct any charges based on partial payments or date changes.

The finance charge is calculated and recorded for each invoice based on the invoice terms and the default finance charge settings in the customer record Terms tab. The following sections will explain the formula used to calculate finance charges for each invoice.

Days Overdue

The finance charge is calculated by determining the number of days that each invoice is overdue. The EBMS software will calculate overdue charges by the number of days from the invoice beginning date to the end date. The end Date is entered on the Update Finance Charges dialog launched from Sales > Update Finance Charges menu option. The beginning date used to calculate the overdue period can be one of the following 3 options:

-

Invoice Date - This option calculates the finance charge based on the original invoice date. This option is the most common method of calculating finance charges. For example, if an invoice was processed on April 15th with 30-day terms and no extra grace period, the system will use the following formula to calculate the overdue period: 35 Days overdue = End date (date finance charge was processed) of May 20th - Beginning date (invoice date) of April 15th.

Some would state that this method does not give the customer any grace period. Note that the finance charge process is normally launched only once or twice a month. The customer would have a grace period between the time the finance charge process is launched, and when the customer pays the invoice. -

Due Date - This option calculates the beginning date based on the Due Date rather than the Invoice Date. This option would calculate 5 days as the total overdue days rather than 35 days in the example above.

-

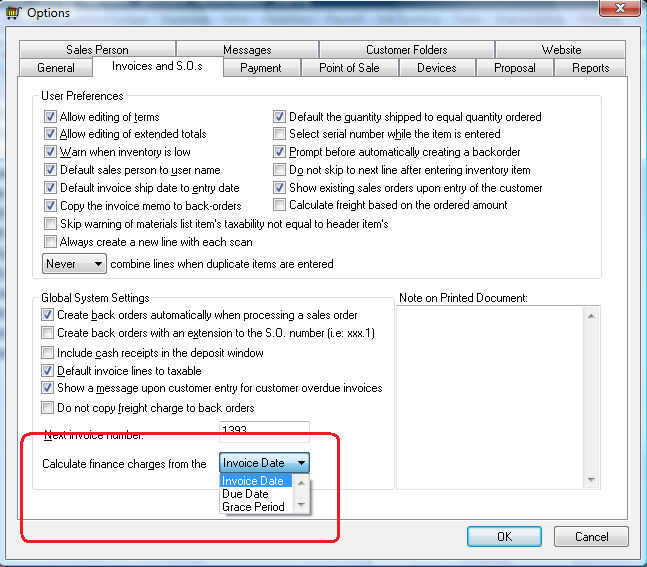

Grace Period - This option calculates the overdue days from the Grace Period setting within the customer's term record. Go to Sales > Options and click on the Invoices and S.O.s tab as shown below to view or change the begin date:

Grace Period

Finance charges will not be levied for an invoice if the process date is within the invoice's terms or within the grace period entered within the customer record. The due date and the grace period date for a specific invoice can be accessed by selecting View > Advanced Options from the sales invoice menu and checking Due Date and Grace Period on the Options tab. Keep reading for more instructions on how to change terms or grace period settings for a customer or group of customers.

Finance Charge Calculation

The finance charge amount is calculated using the Monthly Finance Charge Rate (RATE) entered in the Terms tab of the customer record. Finance charge amount = RATE * 12 * balance * (Overdue days / 365). The system will adjust the finance charge amount based on partial payments made during the terms period.

The finance charge will equal the Minimum Finance Charge if the finance charge calculation for an invoice is less than the Minimum Finance Charge entry within the customer's terms record.

Finance Charges for Credits

Finance charges for invoices with credit balance (credit memos) will be zero unless the total finance charge due for all the customer's outstanding invoice is positive at the time the finance charge was calculated. The purpose of a negative finance charge on a credit memo is to offset the total finance charge in the following situation:

Invoice amount of $1000.00 that is overdue for 30 days with a finance charge of $20.

A credit memo is issued for -500.00 s that is also "overdue" for 30 days with a credit of $10.

Another invoice of $200.00 is overdue for 10 days with a finance charge of $12.

The total finance charge is only $22 for both overdue invoices since a credit of $10 was included in the finance charge calculation.

Note that the finance charges for all documents would be zero if the finance charge total is equal to or less than zero.

Configuring Customer Terms

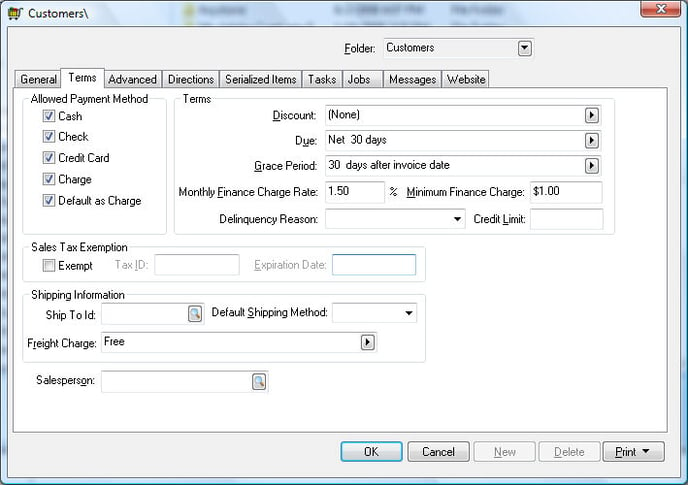

Go to Sales > Customers, select a customer record, and go to Terms tab > Monthly Finance Charge Rate settings to change a finance charge rates for a specific customer.

Complete the following steps to change the default finance charge rate for all customers:

-

Go to Sales > Options > Customer Categories tab.

-

Highlight the root folder titled Customers. Click on the Edit Defaults button.

-

Click on the Terms tab and the following window will appear:

-

Set the Grace Period option. The Grace Period setting affects the finance charge calculation by calculating the finance charge from the grace period date rather than the due date. The Grace Period options are as follows: _ days after invoice date, _ days after due date, or (None).

Select the (None) option to calculate finance charges from the due date. The first two options require the user to enter the number of extra days in the grace period.

-

To set a default Monthly Finance Charge Rate for all customers:

-

Right-click on the Monthly Finance Charge Rate field and select Filter Down on the context menu.

-

This will open a Filter Down window with two options:

Option 1: Check this box to change existing data along with the folder defaults

Option 2: Check this box to include all sub-folders within this folder

Turn both switches ON and click OK to change finance charge rates for all customers. WARNING: This step overrides any unique rate entered in a specific customer record Advanced tab.

-

Enter the desired Minimum Finance Charge for all customers. This minimum charge is per overdue invoice and is not affected by the length of time that the payment was delinquent unless the calculated charge is greater than the Minimum Finance Charge. To set no default minimum charge, set the Minimum Finance Charge field to zero.

-

To apply the Minimum Finance Charge to all customers, right-click and Filter Down in a similar way as the Monthly Finance Charge Rate entry explained above. Select both options to override any customer-specific minimums. For more details in filtering down information, review the Change Defaults, Filter Down Data and Globally Change Data section of the main documentation for more details.

-

Launching the Update Finance Charge Process

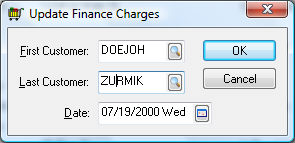

Each time customer statements are printed, the user will be prompted to run the finance charge process. Review the Printing Customer Statements section for details on processing statements. To run the finance charge process independently of printing statements, go to Sales > Update Finance Charges and the following dialog will appear:

-

Enter the range of customers that you wish to charge finance charges on overdue invoices. (If you only wish to update finance charges for one customer, enter them as the first customer and last customer.) The finance charge will be calculated on the time period between the specified Date and the invoice date.

-

Click OK to update the finance charges.

Sending Statements

Review Printing Customer Statements to configure and print customer statements

Review E-commerce > Customer Portal > Online Statements to configure and post the statement online on a customer portal.