Use Tax Exempt

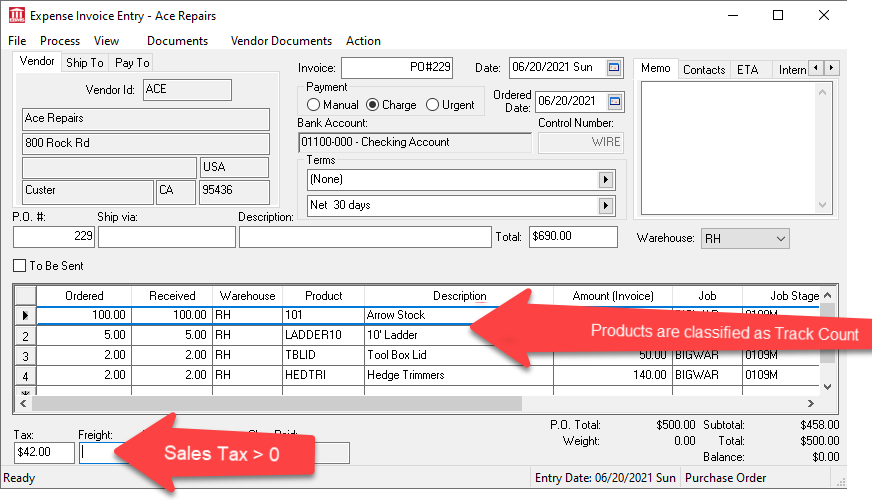

All items that are purchased on a sale that includes sales tax are exempt from use tax. Any perpetual inventory that is purchased on an expense invoice that includes a sales tax value within the footer is considered use tax exempt.

Perpetual inventory must be enabled, and the product must be classified as Track Count, Serialized, Lots, or any other perpetual classification. Some products sold using a FIFO method may be exempt and other products on the same sales line may be subject to use tax.

The following methods may also be used to make a consumed item exempt from use tax:

-

Customer is tax exempt: Review Configuring a Tax Exempt Customer to configure a customer as tax exempt.

-

Job is tax exempt: Review Configuring Use Tax for a Job for setup instructions.

-

Product is tax exempt: Review Inventory Tax Groups to create product exempt groups.