Entering Existing Fixed Assets

How to add existing depreciable assets to EBMS

All existing depreciable assets should be entered into the EBMS deprecation module before continuing with any processes. This includes all new fixed assets that are partially or fully depreciated. This section describes the steps required to enter existing assets. NOTE: The following steps will not work if the optional Depreciation module is not installed in EBMS.

Open the depreciation list by selecting Financials > Depreciation > Depreciable Assets from the main menu.

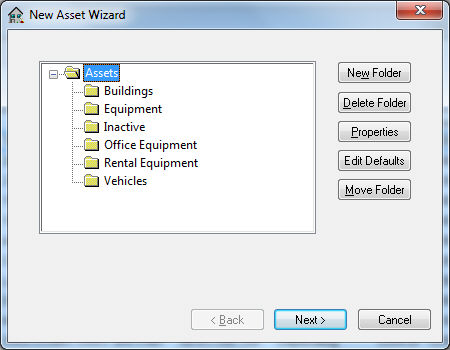

Click the New button to open a New Asset Wizard:

Highlight the category folder where the new asset will go and click Next. See the Adding or Deleting Asset Folders section for details on creating new category folders.

-

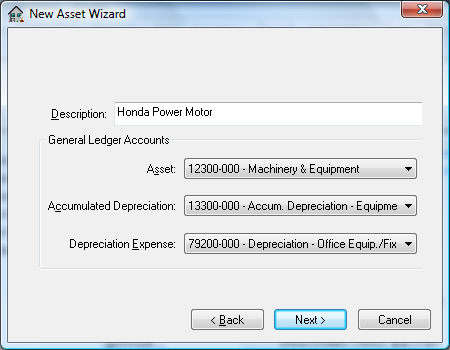

Enter a Description to identify the specific depreciable asset.

-

Enter the Asset general ledger account to contain the purchase value of the depreciable asset item.

-

Enter the Accumulated Depreciation general ledger account. This account must be an asset account that is classified as Accumulated Depreciation.

-

The Depreciation Expense account must be an expense account that is classified as Depreciation Expense within the General Ledger. See the Account Classification section for more details on classifications.

Click the Next button to continue to the depreciation method page.

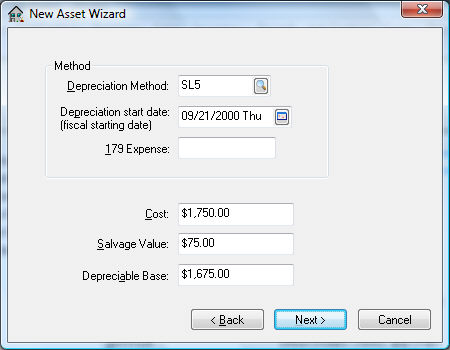

- Enter a Depreciation Method by clicking on the lookup button and selecting a method. This method can be changed at a later time if the method isn't yet determined. See the Depreciation Methods section for more details on creating methods. See the Changing an Asset's Depreciation Method section for details on changing the depreciation method for an existing asset.

-

Enter the Depreciation Start Date of the asset. This date must fall within the fiscal year in which the first depreciable asset is processed and may not be the same year as the purchase date. The process date may not be the same year as the purchase date if the asset is not to be depreciated immediately. The depreciation schedule will use this date to determine in which fiscal years the depreciation is scheduled.

-

Enter the purchase Cost of the asset. This should include the total value of the asset at the time of purchase.

-

Enter the 179 Expense. This is the additional Section 179 depreciation that will be expensed the first year. This field can be kept blank to depreciate the asset completely using the selected method. Contact your accountant to determine the amount of this entry.

-

Enter the estimated Salvage Value of the asset at time of disposal. This amount will be deducted from the Cost to calculate the Depreciable Amount. (Depreciable Amount = Cost – Salvage Value.) The depreciation schedule will be determined using the Depreciable Amount.

Click the Next button to continue to the transactions page:

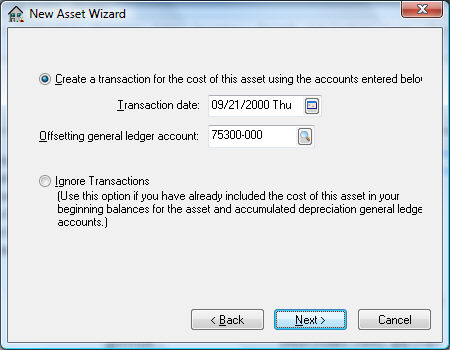

The first option is recommended if the depreciation module of EBMS has recently been installed, and the depreciable asset values are already reflected within the general ledger. Complete the following steps if the Create a transaction for the cost of this asset using the accounts entered below option is selected:

-

Enter a Transaction Date within the last fiscal year to post past asset values to the prior year. The adjustments posted to last year will create the correct beginning balance for the asset general ledger account for the current fiscal year.

-

Select the Offsetting general ledger account that will be credited. Enter an expense account that was used when the depreciable asset was expensed if the item was purchased within existing open general ledger fiscal periods. Otherwise use an equity type or other general ledger account.

Click the Next button to open the following status page:

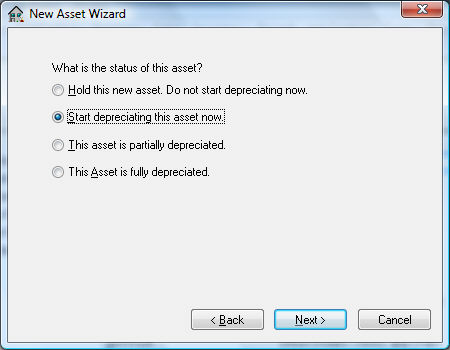

Select one of the following status options for the asset:

- Hold this new asset. Do not start depreciating now. This option is the only available option if no depreciating method has been entered for this asset. The Hold option will record the asset but will not process any accumulating depreciation and is useful if the user wishes to obtain advice on the appropriate depreciation method. The asset status can be changed to a depreciating status at anytime. See the Changing Methods within an Asset section.

- Start depreciating this asset now. This option will cause the asset to start depreciating at the time of the next Monthly Process. See the Depreciating Assets Using the Monthly Process section for more details on processing depreciation.

- This asset is partially depreciated. This option should be used for any asset that has already been partially depreciated. This option should only be selected when the EBMS Depreciation module is initially installed and setup.

- This Asset is fully depreciated option should only be used for asset items that are currently listed on the financial statements and are fully depreciated. This option is also used when entering the initial asset list. All assets that are reflected on the company’s balance statement should be entered into the EBMS depreciation system. See the Removing Disposed Assets section for instructions on how to remove disposed assets from the list.

Click the Next button to continue.

NOTE: The following two wizard pages will not appear if the depreciation method has not been entered on page 3 of the wizard process.

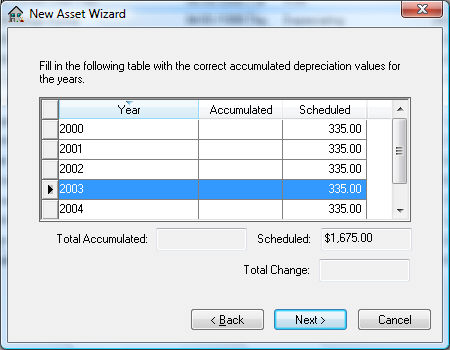

A table will be displayed listing the Scheduled depreciation on the right and the Accumulated depreciation on the left, as well as the Year.

The Year column will be sequentially incremented based on the Depreciation Start Date of the asset and cannot be changed without changing the Depreciation Start Date. The wizard must be canceled and restarted if the Depreciation Start Date or the Method is incorrect. The wizard cannot be paged backwards at this point.

Enter the Accumulated depreciation if the asset has been partially depreciated. Change the accumulated depreciation for each year if the asset is fully depreciated and the Scheduled depreciation does not match the annual amount depreciated.

The Scheduled depreciation is calculated using the Depreciation Method entered earlier in the wizard. This amount can be changed to match a user’s schedule without having any ill effects on the accuracy of the system. Any changes to the Scheduled amount must equal the total Depreciable Amount for the asset.

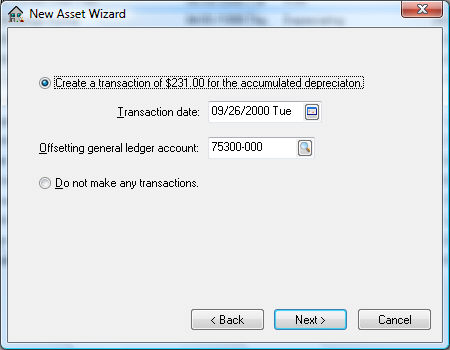

The following page will appear only if the Accumulated depreciation column of the previous page contains any value.

Select the Do not make any transactions option only if all the accumulated depreciation values have already been entered into the balance sheet of the general ledger. Otherwise, select the Create a transaction of [$] for the accumulated depreciation option to create general ledger transactions for accumulated depreciation. Complete the following steps if the Create a transaction… option is selected:

- Enter a Transaction Date within the last fiscal year to post past accumulated depreciation values to the prior year. The adjustments posted to last year will create the correct beginning balance for the asset general ledger account for the current year.

- Enter a depreciation expense general ledger account as the Offsetting general ledger account that will be credited.

Click the Next button to proceed to the final page.

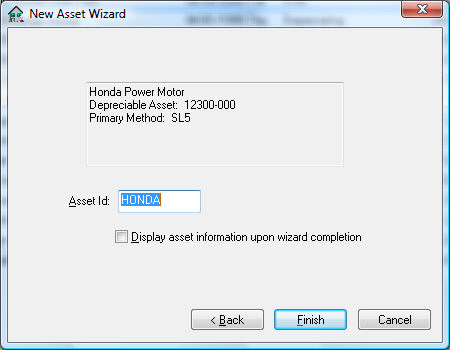

Enter the Asset ID code. Checking the Display asset information upon wizard completion option will open the Depreciable Asset information window.

Click Finish to add the new depreciable item.

Continue with the next section to view or change depreciable asset information.