Process and Print W2s

W2 Forms can be printed for the past year after the payroll year is closed and payroll has been entered and processed within the new year. To order preprinted W2 forms, contact your Koble Systems account manager. Order a few extra forms in case any W2 forms need to be reprinted.

The user should verify the employee’s general information as well as tax deductions and gross pay before W2 forms are printed. Proceed with the following steps to verify payroll information.

-

From Labor > Workers, double-click on a worker ID to open the worker record. Go to a worker record General tab to verify the worker's last name, first name, and address information (Address, City, State, and Zip).

-

Click on the Personal tab and verify the worker's Social Security Number, the Head of household, Deceased, and Legal Representative options are properly set. See W2 instructions or contact your accountant for detailed explanations of these options.

-

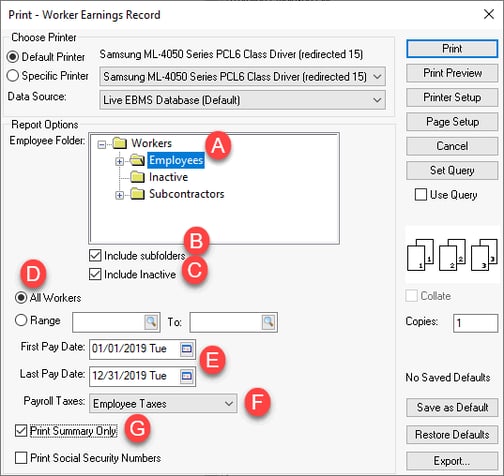

Print the Employee Earnings Record report to list all gross pay, taxes, and deductions withheld from a list of employees. Navigate to File > Reports > Labor > Workers > Employee Earnings Record from the main EBMS menu. Double-click on the report name to open the Print and Report Options page.

-

Select the folder that includes ALL employees but exclude any non-W2 employees.

-

Make sure the Include subfolders option is enabled to include all employees.

-

Verify that the Include Inactive option is enabled to include inactive employees who were on payroll during this data range even if they are inactive at the current time.

-

Select All Workers.

-

Set the First Pay Date to 01/01/yyyy. Set the Last Pay Date to 12/31/yyyy. Select the W2 year for the first and last date. Note that all workers with pay within the First Pay Date and Last Pay Date range will be included in the list

-

Set the Payroll Taxes option to Employee Taxes.

-

Enable the Print Summary Only option to only list annual totals.

-

Review an individual employee’s withholding taxes and deductions recorded within the worker record Worker Taxes tab. Select a tax and click on the Properties button to review the amount withheld, taxable gross, and gross amounts for each tax or deduction. The history is found on individual year history tabs.

Adjusting W2 Values

The preferred method to adjust tax withholding and taxable pay amounts to be edited using a journal entry. Review the Year End Payroll Adjustments section to adjust an employee’s gross pay, workweeks, amount of tax withheld, and taxable gross amounts.

Some deduction totals printed on the W2 form can be manually adjusted such as EIC payments, benefit adjustments, dependent care benefits, etc. Any tax or deduction that is listed on the W2 form must be listed within the Worker Taxes tab of the employee window. For example, if benefit adjustments need to be listed on the W-2 form but no benefit adjustments have been processed for the employee, the user must complete the following steps:

-

A deduction must be created and classified as a Benefit Adjustment if it has not already been created. The benefit adjustment deduction must be listed in the employee’s Employee Taxes tab. Review the Adding New Taxes and Deductions section for details on creating new taxes.

-

The amount can be entered or adjusted by going to Labor > Workers and double-clicking on a worker ID to open their worker record.

-

Go to the year tab that corresponds with the W2 and click on the W2 Adjustment button. (See image above.) The following window will open:

-

Tax or deduction adjustments can be entered into the Adjustment column to adjust some taxes or deductions. Many taxes such as Federal Withholding or Medicare cannot be adjusted directly in this screen. An adjustment journal must be entered for these taxes, which is explained in a previous section - Year End Payroll Adjustments. Additional information can be manually typed into box 13 and box 14 of the W-2 form by entering information within the W2MEMO13 and the W2MEMO14 memo fields.

-

All taxes and deductions are placed within the W2 forms based on the deduction types. To view the position of a specific tax amount on a W2 form go to Labor > Taxes/Deductions > General tab and click on the magnifying glass icon in the Type field. The following list will appear:

The W-2 Position column identifies the specific box within the W2 form that will display the tax total. For example, any deduction that has a tax type of Medicare will be displayed within box 6 of the form. The W-2 Prefix code is displayed when a deduction total is listed within box 13 or 14.

The W-2 Position, W-2 Prefix code, and the manual adjustment option are set within the PYTXTYPE.DBF file and must be changed with a dbase file editor. Contact a Koble Systems consultant if you wish to change these options.

Verify W2 Information

The following company information should be verified before W2s are printed:

-

The Company Name and Address located in File > Company Information > General tab.

-

The SS/EMP. ID# located in File > Company Information > Advanced tab. The Employer Identification Number or Social Security Number should be entered in this field.

-

Select the Payroll Payer Type. Contact your accountant or a Koble Systems consultant if you are not familiar with this setting.

-

All states in which employees reside should be listed along with the State ID#. This information will be listed at the bottom of the W2 form. The State column should reflect the 2-letter abbreviation of the state.

NOTE: The state income withholding tax ID code must equal the state abbreviation entered in the State column. This is required to properly print the W2 forms.

Printing W2 and W3 Forms

Review Electronic W2 Filing for instructions to electronically file W2 forms.

Review Annual Payroll Reports for yearend W2 and W3 printing instructions.

Review Auto Send to a Group of Accounts for instructions on how to use Auto Send to send Worker forms, including W2 forms.