Voiding a Sales Invoice

An invoice can be unprocessed to edit, make corrections, or void an invoice. Negative transactions are posted to the general ledger when an invoice is unprocessed. These negative transactions offset the original transactions posted when the invoice was processed. An invoice must be unprocessed before it can be deleted.

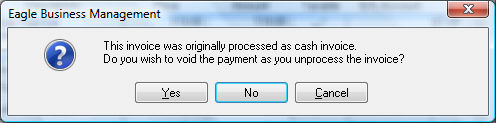

The user has the option to void the payments if the invoice was processed as a cash invoice. Any payments posted to a charge invoice will NOT be voided but will be recorded as down payments to the sales order. Review the Payment Methods and Terms section for more details on down payments. Any payments must be voided before an invoice can be deleted. Review the Viewing or Voiding Customer Payments section for more details.

An invoice may need to be voided for the following reasons:

-

A user entered incorrect sales invoice information, and the data needs to be changed. This could be a wrong G/L code, wrong invoice date, invalid pricing, wrong inventory code, etc. This type of inaccuracy can only be fixed by voiding the original invoice, changing the incorrect data, and reprocessing it. After an invoice is processed, most of the information cannot be changed, since the transactions were used to update a variety of history information.

-

The invoice was accidentally processed.

-

A processed invoice cannot be deleted directly but must be voided before the unprocessed invoice (sales order) can be deleted.

Unprocess an Invoice

-

Open and view the invoice to be voided. Review the Viewing a Sales Invoice section for further details.

-

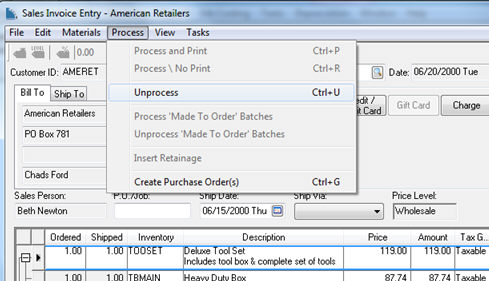

Select Process > Unprocess from the invoice header menu or press Ctrl + U on the keyboard.

-

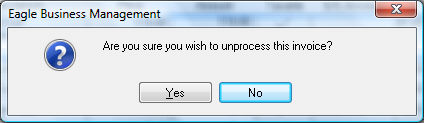

Click Yes to continue with the void action or No to cancel. The following dialog will appear if the original invoice was processed as cash.

If Yes is selected the Invoices and sales order window will open with the unprocessed invoice (sales order) displayed. Make the desired changes and either save or reprocess the sales order.

NOTE: You will not be able to void an invoice that was processed within a fiscal year or month that has already been closed. If it is not possible to void the invoice, enter a credit to offset the transactions that were created by the original invoice.