Credit Offset Transactions

Offset transactions are created only for non-Inventory product codes such as No Count, Service, Non-Inventory Serialized Item, and Rental Code. These transactions are only created when No Count items are applied to a job or consumed within a manufacturing batch.

Credit Offset Transactions ERP Support Training

The following settings determine if the MFG/Job Cost Offset transactions are created within an expense invoice, job transfer, sales invoice, or manufacturing batch:

-

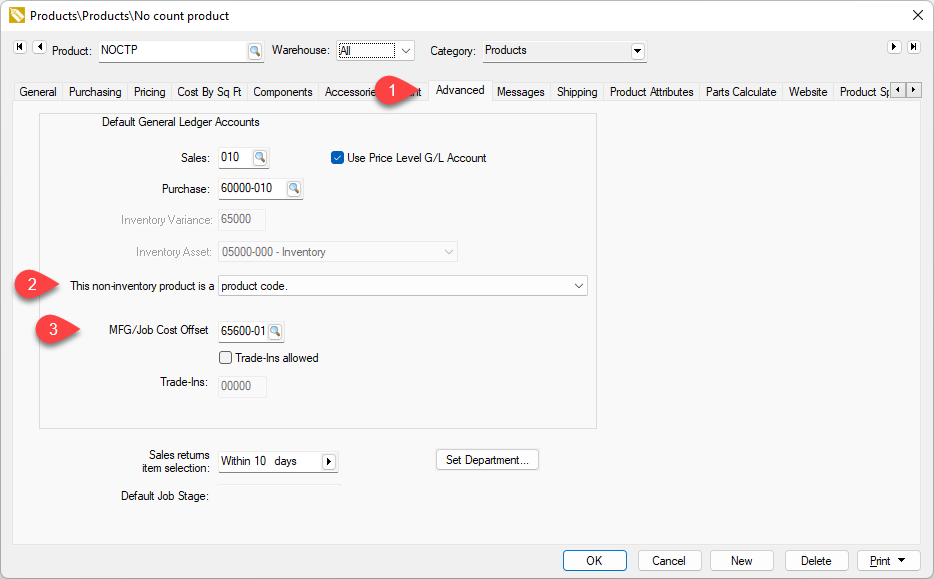

Open the advanced tab of a product code classified as No Count.

-

The shortcut for a non-inventory product option MUST be selected to create credit offset transactions.

-

The MFG/Job Cost Offset account must be set to identify the credit offset financial account.

-

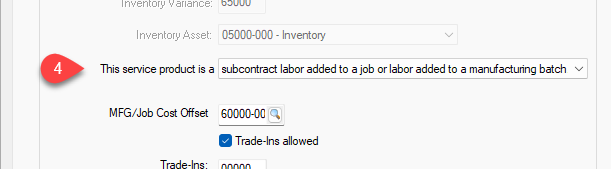

The service product option setting must be set to subcontract labor if the product is classified as Service.

-

Select the shortcut option if the product code identifies expenses that are not actual product or labor. No credit offset transactions are created if the shortcut option is selected. Review [Inventory] Product Catalog > Using Product Codes for No Count Items > Product Shortcuts and Credit Offset Switch for information on the shortcut/product option.

-

Select the labor or service billing code option if the service product code does not identify subcontract labor and is not added to a manufacturing batch or job transfer. Review Subcontractor Labor within a Job Transfer or [Inventory] Adding Labor, No Count, and other Costs to a Batch for information on the labor or service billing code option.

-

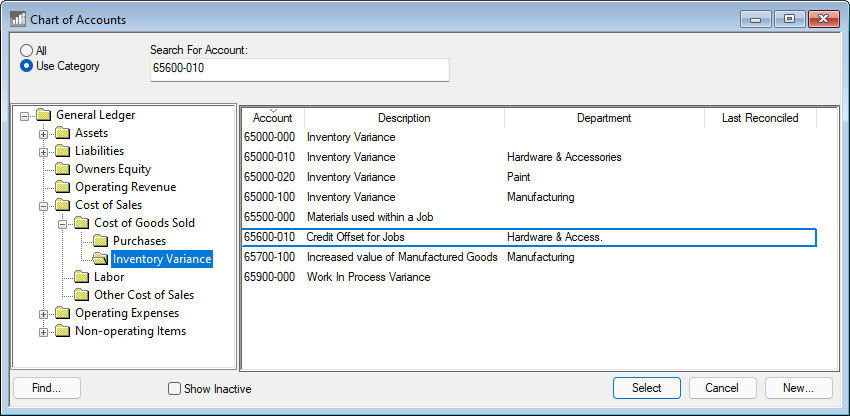

Set a manufacturing or job cost offset financial account into the MFG/Job Cost Offset entry. This credit account is often a separate account to allow an accountant to monitor the amount of inventory that is purchased as an expense but then added to a job or finished goods inventory.

Jobs: Credit offset transactions are created when no count products are moved to a job using one of the following tools:

Manufacturing batch: Credit offset transactions are created when no count products or service codes are included in a manufacturing batch. Review [Inventory] Manufacturing > Creating a Batch > Adding Labor, No Count, and other Costs to a Batch.

Typical Cost-of-Goods-Sold (COGS) Transactions

The following transactions are used in COGS processes within job costing and manufacturing modules:

-

Typical track count inventory transactions (Credit offset transactions are not created)

- Job costing: Product values are moved directly from the inventory asset to a job through a transfer or on an expense invoice.

- Manufacturing: Consumed item values are moved from the inventory asset to the finished goods.

-

No Count products are purchased and then moved to a job or manufacturing batch. Note that the product shortcut option must be disabled to identify No Count products and create credit offset transactions.

-

No Count items are expensed (debited) when purchased instead of added to inventory assets.

-

Credit offset transactions are credited to offset the purchase debits. These transactions are created in the following processes:

-

Review Jobs > Job Costs > Product Items and Job Costs for more information on applying products to a job.

Review [Inventory] Manufacturing > Adding Labor, No Count, and other Costs to a Batch for more information on applying No Count products to a manufacturing batch.