Prevailing Wage Rates

Prevailing wages are normally set based on the type of work performed on the job. The variable rates are set in EBMS using the work code and job.

Work Codes

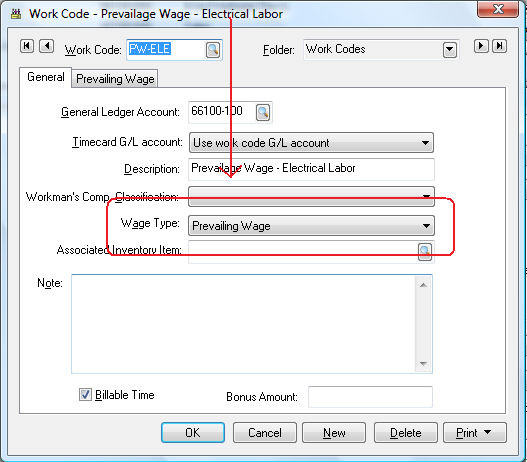

Click on Labor > Work Codes to set the rate for each work code. Create a separate work code for each type of task that requires a different prevailing wage rate. Review the Creating Work Codes for Prevailing Wage Rates article for more details on creating work codes for prevailing wages.

On individual work code records, a Prevailing Wage tab will appear if the Wage Type is set to Prevailing Wage as shown above. Click on the Prevailing Wage tab to view or edit jobs.

Job Settings

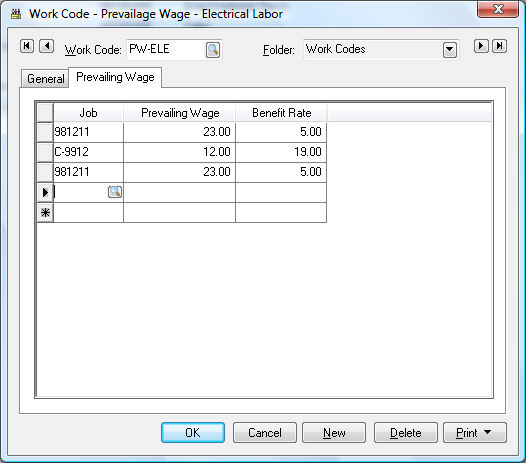

The following job list will appear on the tab if the optional Job Costing module is installed within EBMS. Otherwise, the Prevailing Wage tab will show a single set of rates. The Job Costing module must be installed to set prevailing wages based on the job. Contact your Koble Systems account manager for more details on the job costing module.

The Prevailing Wage tab will show a table of job entries if the Job Costing module is installed. The prevailing wage rate consists of two elements: Prevailing Wage and the Benefit Rate.

Worker Settings

The employee is paid a minimum of the Prevailing Wage rate and a maximum based on the Prevailing Wage rate plus the Benefit Rate.

Minimum = Prevailing Wage

Maximum = Prevailing Wage + Benefit Rate

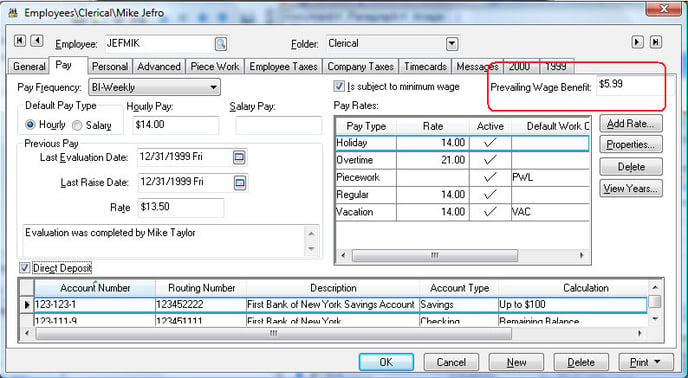

Based on an example shown above, for Job 981211, the employee will be paid a minimum of $23 an hour for the job or a maximum of $28 an hour based on the Prevailing Wage Benefit set within the worker record. Click on the worker record Pay tab to set the Prevailing Wage Benefit rate as shown below: The Prevailing Wage Benefit rate should reflect the total hourly value of the benefits given to an employee such as holiday pay, vacation pay, medical insurance, and any other company paid benefit. This hourly rate will be used to calculate the prevailing wage within the timecard.

The Prevailing Wage Benefit rate should reflect the total hourly value of the benefits given to an employee such as holiday pay, vacation pay, medical insurance, and any other company paid benefit. This hourly rate will be used to calculate the prevailing wage within the timecard.

The worker's pay equals the Prevailing Wage rate within the work code tab plus (the Benefit Rate within the work code – Prevailing Wage Benefit rate set within the worker record). [Worker Pay = Work Code Prevailing Wage + (Work Code Benefit Rate - Worker Record Prevailing Wage Rate)]

If the Prevailing Wage Benefit rate within the worker record is greater than the Benefit Rate within the work code, the total pay will be equal the Prevailing Wage amount found in the work code.

Using the worker record example shown above, Mike Jeffro (JEFMIK) will be paid a prevailing wage of $5.99 an hour for electrical labor (PW-ELE work code) for the 981211 job.

Note: The formula set for hourly pay must be set to use the hourly pay setting within the worker record Pay tab for prevailing wages to be calculated properly. For example, the Regular pay type formula must be set to Equal to rather than set to a specific rate. Review the Setting Employee Defaults section for more details on setting pay rates.

Overtime pay rates are calculated based on the average pay on the timecard, rather than calculated from the hourly pay rate entered in the Pay tab of the worker record. Review the Calculating Overtime section for more details.

Reports

Go to File > Reports > Labor > Pay Periods from the main EBMS menu to view prevailing wage reports.

Prevailing wage reports can be found within the Labor > Pay Periods section of the reports menu as shown above. Prevailing wage reports are useful to communicate certified payroll job summary to the state.

Choose between Prevailing Wages for Job & Pay Period or Prevailing Wages for Pay Period.