Accounts payable (A/P) are unpaid expense invoices owed to vendors. Unpaid invoices generally include terms for payment within an agreed time frame. Accounts payable is shown on a balance sheet as a liability. It is one of a series of accounting transactions dealing with the expenses or purchases from a vendor that has been received but not paid. These may be distinguished from notes payable, which are debts created through formal loan process.

Accounts Payable Balances

Accounts payable general ledger accounts within EBMS record the balance due to vendors. The balance of all A/P accounts must equal the history balance recorded for all vendors.

Vendor annual history tabs: Review Vendor History to review the invoices and payments to individual vendors.

Reconcile balance with financial totals: Review Verify General Ledger Balances for steps to run a utility to reconcile accounts payable.

The EBMS software facilitates the ability to create multiple accounts payable financial accounts.

Reconcile Accounts Payable Balance

The most effective way to evaluate A/P balances is to combine the totals for all account payable accounts. Complete the following steps to reconcile accounts payable balances.

-

Launch the from the main EBMS menu. Review Verifying General Ledger Balances Utility for more details. Verify that the Month and Fiscal Year setting on the utility matches the period you wish to reconcile. All comparison reports need to match the fiscal period.

-

The Accounts Payable balance in the left column of the utility reflects the total of all A/P accounts. If the A/P balance needs to be adjusted, try one of the following:

-

Verify that all accounts payable accounts in the general ledger are classified as accounts payable. Review Account Classification for details on setting or changing an account classification.

-

Use a journal entry to adjust the accounts payable financial account balance. Review the Creating Journal Entries documentation.

-

-

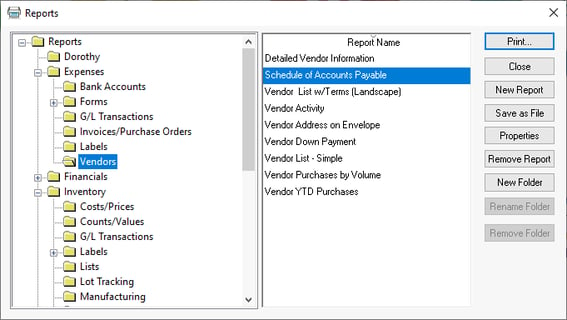

If the Vendors balance on the right column is incorrect, then go to File > report and run the report. (See a copy of the report below.) Adjust any expense invoices or payments to balance the accounts payable accounts with the balance of all expense invoices.

-

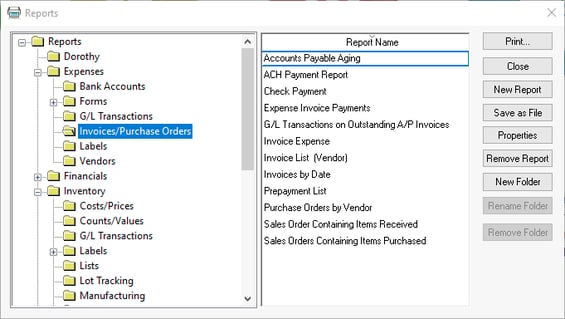

An accounts payable aging report is located at File >

Accounts Payable Reporting

Accounts Payable Aging Report

The Accounts Payable Aging Report compiles a complete list of outstanding invoices for each vendor along with aging details. This report can be accessed by selecting from the main EBMS menu and then selecting report as shown below:

The report can be generated with an accurate aging and invoice balance list based on a past date. On the Report Options page, the option Show Overdue Invoices Only can be selected to only show invoices that are past the due date.

Schedule of Accounts Payable Report

The Schedule of Accounts Payable report contains a summary A/P balance for each vendor. This report can be accessed by selecting from the main EBMS menu and then selecting report as shown below:

The Schedule of Accounts Payable report can be dated based on past monthly periods. This report can be used to list A/P details based on the end of past years, quarters, or months.

The summary of all A/P accounts will be listed, and a note will indicate if the vendor balance does not match the general ledger account balance.

Review Financial Reporting > Overview for a complete list of financial reports.

Subsidiary Ledger

The monthly balance of each vendor is found on each vendor's history tab.

Drill down on monthly invoice or payment by double clicking on any total to view the detailed transactions. Click on an individual record to view the expense document. Review Vendor History for more information on this subsidiary ledger.

Increasing and Decreasing A/P Balance

The following transactions affect the accounts payable balance, including invoices and credits for the vendor. Note that purchase orders do not change the A/P balance until a purchase order is processed into an invoice.

- Processing an expense invoice: Review Processing an Invoice for details on the processing step.

- Voiding a vendor invoice: Review Changing or Voiding Vendor Invoices for steps to reverse A/P transactions.

- Processing vendor credits or refunds: Review Processing Vendor Credits and Refunds for instructions on processing vendor credits.

- Processing a journal entry to adjust a balance: Review Expense Journal Entry to make manual accounts payable balance adjustments.

The Accounts Payable balance decreases as payments are made to vendors:

- Vendor payments: Review Selecting Invoices to be Paid for instructions to process various payment options, including printing checks, ACH, credit card, and manual checks.

- Processing paid outs using cash: Review Paid Outs for instructions to enter and process cash paid outs.

- Voiding a check: Review Voiding a Check for instructions to reverse a payment.

- Voiding direct payments: Review Voiding a Direct Payment for instructions to reverse ACH payments.