Financials Overview

Back office management and accounting tools.

In this article:

Getting Started | Video Walkthrough | Features | Enhancements | Sample Reports | Related Content

Getting Started

The Financial module is the main module of the accounting system - think of financials as the hub of a wheel. This is where transactions from accounts payable, accounts receivable, payroll, and journal entries all come together to give a complete picture of the company's financial situation.

Financial reports are derived from the EBMS general ledger account system and can supply detailed and up-to-date information about the company's financial status.

Financial Tools

-

Fiscal Year: Review Fiscal Year Controls to set up the fiscal year and manage the monthly fiscal periods, including the 13th month.

-

Chart of Accounts: Review Chart of Account Folders to configure the central general ledger chart of accounts and organize both the balance sheet and income statement financial accounts.

-

Financial Transactions: Review Transaction Overview to review the comprehensive financial audit trail available throughout EBMS.

-

Account reconciliation: Review Account Reconciliation Overview for instructions to reconcile financial accounts with the ERP balances throughout EBMS.

-

Departments and Profit Centers: Review Department and Profit Center Overview for information on the flexible tools to manage departments, locations, profit centers, and divisions within a company.

-

Budgeting: Review Budget Overview to create and manage multiple year budgets including advanced budget formula options.

-

Depreciation: Review Depreciation to manage fixed assets and the monthly depreciation cost allocation.

-

Fund accounting tools: Review Fund Accounts for nonprofit organizations that need to manage fund balances.

-

Reporting: Review Reports Menu for an overview of the comprehensive financial reporting options.

-

Account History: Review Account History Tabs to quickly access financial transaction details.

Financials

The EBMS system uses a monthly reporting system with flexible fiscal year controls. A total of twenty-six monthly periods can be open at a given time (2 years at 13 monthly periods per year) and these periods can be closed, reopened, or altered to give the user maximum flexibility without compromising the information. Review the Fiscal Year Overview for more details on creating fiscal years or closing periods.

Financial Settings

The financial settings must be configured properly to match the accounting fiscal year before continuing with the EBMS setup. Please verify these settings with the company accountant before proceeding.

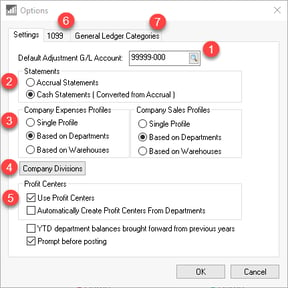

Review the following options to configure some of the more advanced EBMS accounting tools. Open this dialog by selecting Financials > Options from the main EBMS menu.

-

Default Adjustment G/L Account: The adjustment account should be limited to miscellaneous adjustments such as cash adjustments. Review Account Reconciliation - General Adjustments for more details on this account.

-

Accrual Statements or Cash Statements: EBMS creates accrual transactions but contains a utility to covert to cash based financial statements for tax purposes. Review the Create Cash Accounting Adjustments article for more details on the option to generate cash accounting reports.

-

Company Expenses Profiles and Company Sales Profiles: These settings are used to create divisions or departments within a single company. EBMS includes the capability to manage the company with multiple departments, profit centers, or divisions without dividing the company into completely separate entities. The unique overhead distribution to the different profit centers is powerful in summarizing a product line, department, or division.

-

The Company Divisions button is used to create separate divisions with multiple addresses, logos, and other company settings without creating a new company within EBMS. Review the Using a Department as a Company Division or Location article for more details.

-

Profit Centers: Various profit center settings are reviewed in the Departments and Profit Centers Overview section.

-

Review the 1099 Forms > Overview section for more details about the settings within the 1099 tab.

-

EBMS includes a number of valuable features to assist the manager in managing the financial records of the company, such as flexible Chart of Accounts numbering, structure, and grouping. Review the following documentation for more Chart of Account details:

-

-

Chart of Accounts structure: Review the Chart of Account Folders section for instructions on organizing accounts to meet specific financial reporting needs.

-

Creating financial accounts: Review the Adding General Ledger Accounts section for more details on creating new accounts.

-

Account Classifications: This setting is important throughout the EBMS system in order to identify various balance sheet accounts, 1099s, and other financial reporting. Review the Chart of Accounts Classification section for more details.

-

The software contains an extensive audit trail to verify each total within the Financials section. This important feature facilitates the ability to quickly and accurately verify totals and identify the source of all transactions. Review the Chart of Accounts > Find the Source Documents using the Financial Audit Trail section.

EBMS creates all transactions on an accrual basis to enhance the management capabilities of the system but allows the user to print year-end statements on a cash basis. Review Create Cash Accounting Adjustments for more details in generating cash financial statements. Account reconciliation, budgeting, 1099 tracking, fund accounting tools, and flexible reporting are all valuable capabilities of the general ledger module.

The general ledger is made up of a Chart of Accounts. Go to Financials > Chart of Accounts within the EBMS menu to open the following dialog:

Each account is similar to the columns in a manual ledger book. In a more complete manner, a chart of accounts is a way of arranging assets, liabilities, equity, revenue, cost of sales, and other expenses into a logical order. Each expense account should be set up as a separate ledger account. The different accounts will have account numbers as a reference. EBMS includes a default chart of account, but changes can be made to this generalized system by the user as necessary. Your company's chart of accounts should be tailored to reflect the type of business or service you operate.

The first accounts listed in a chart of accounts are Assets, Liabilities, and Equity, in that order.

- Assets: Things owned, such as cash, accounts receivable, inventory, equipment, and buildings, are classified as assets. There are also contra-asset accounts for accumulated depreciation on equipment and buildings. These contra-asset accounts are used to reduce the value of assets for depreciation and other similar types of expenses.

- Liabilities: Things owed, such as accounts payable, payroll taxes payable, equipment loans, and mortgages, are classified as liabilities.

-

Equity: Money contributed by owners, accumulated earnings or losses, and payment for stock (if the business is a corporation) are classified as

The last accounts listed in a chart of accounts are the income statement or profit/loss accounts. They consist of the revenue, or income accounts, the cost of goods sold accounts, and other expense accounts.

- Revenues: Monies received for the services or goods provided by the company.

- Cost of Goods Sold: Direct costs to provide the goods or services.

- Expenses: Expenses include building expenses and utilities. These are the costs of doing business and cannot be attributed directly to any specific goods or services. Miscellaneous income and expenses include revenue and expenses that are not incurred during the regular course of business. An example of miscellaneous income would be the sale of an asset or interest revenue.

General Ledger Adjustment accounts are used when needing to adjust an account to reconcile it with the other data.

EXAMPLE: If your cash account balance does not match the actual cash on hand, an adjustment is required to reconcile the amount of cash on hand with the number that is recorded in the General Ledger Cash Account. Rather than posting this discrepant number to a revenue account or a miscellaneous expense account, it is better to post to an adjustment account. This approach allows the user to view the number of adjustments and the sum of the total throughout the year. Many automatic adjustments made by the software are posted to an adjustment account. Go to General Ledger > Options > Settings > Default Adjustment G/L Account to set the adjustment account that you prefer to use for system adjustments.

A chart of accounts can be as detailed or as limited as required by management, with some accounts being needed to keep accurate records for tax and financial statement purposes. A cash-basis taxpayer's chart of accounts will most likely be considerably smaller than an accrual-basis taxpayer. The decision to be cash-basis or accrual-basis should be discussed with your tax preparer. EBMS processes all Accounts Receivable and Accounts Payable transactions in an accrual-basis to enhance the management reporting of the system. The system will process and print cash financial statements to assist with tax preparation when using the cash method. Go to Financials > Options > Settings > Statements options to set the desired accounting method.

In EBMS, go to the Financials > Chart of Accounts list to open an account. Folders will be discussed in the next section. There are also tabs that can be clicked on to see different types of information about the selected account. Review the General Ledger Chart of Accounts section for more information on General Ledger accounts.

Review the Entering General Ledger Beginning Balances section to add the beginning balances for the financial accounts.

Review Financial Reporting Overview for a sample list of financial reports that can be used to manage the company.

Video Walkthrough

Features Include:

- Complete audit trail where all transactions can be traced to the original source

- Extensive drill down details

- Fiscal year controls

- Unlimited amount of transaction history per month and annually (including detailed transactions)

- Allows posting for up to 26 monthly periods

- Optional 13th month adjustment period

- Flexible chart of accounts structure and grouping

- Multiple Department and Profit Centers management with flexible cost allocation

- Journal entry tools to adjust transactions that include employee W2 balances, bank accounts, receivables, and payables

- Powerful reconciliation facility for any balance sheet account

- 1099 tracking and printing

- Budget Projection capability

- Complete set of financial reports

- Flexible financial reporting

- Cash or accrual based year-end financial statements

- Fund accounts to track multiple expense/revenue funds

- Unlimited number of transactions to provide detailed records for years

Enhancements and Customizations Available

- Expenses

- Profit Center Processing

- Business Budget Utilities

- Fixed Asset Depreciation

- Extensive Reporting

- Payroll

- User-Defined Security Settings

Sample Reports

- Monthly Profit & Loss (P&L) Statement

- Balance Sheet

- Detailed G/L Transactions by G/L Code

- G/L Cash Flow Statement

- G/L Balance Sheet (12 Month Comparison)

- Annual Profit & Loss (8 Year Comparison)

- Chart of Accounts by Classification

Related Videos & Content

Videos

Video: Adjusting Financial Accounts

Video: Fiscal Year and G/L Settings ERP Support Training

Blog Articles

The Numbers Tell the Story - Understanding Business Financials