Process Timecards without Processing Payroll

The labor module of EBMS can be used for a variety of time and attendance functions. These tools include time clocks, task management, and remote work order tools that feed labor details into the timecard.

The clock in and clock out times for projects, the number of hours spent on work orders, the daily start and stop times for each worker - these are all valuable metrics for a labor manager to know. Most companies collect and use this data to process payroll themselves, or they export the data to a 3rd party payroll processor. But there may be scenarios in which the company decides to collect labor data but not process payroll. For example:

-

The company uses the task and work order system but obtains worker timecard information from another source. Since the labor entered in the timecard tab of the task is recorded within the worker's timecard, the following steps are recommended to process the timecard data without processing worker pay.

-

The EBMS user implements the time-tracking tools, job management, and task and work order features, but chooses to wait to implement payroll until the beginning of the next fiscal quarter or fiscal year. The following steps are recommended to process the labor details until payroll is implemented.

-

A service department has implemented the task and work order features or the job management features for a subgroup of workers within the company. The legacy time-tracking system which is used by all workers is used to record payroll information. The following steps are recommended until the entire company can implement the EBMS time-tracking system. The time can be processed using the following tools if the EBMS payroll processing system is not used:

-

3rd Party Payroll: Review 3rd Party Payroll Service Overview for instructions to use the EBMS Labor module and peripherals to record and manage labor hours and export the payroll information to an external processor.

-

1099 Subcontractors: Review Adding and Deleting Worker Categories for instructions to create folders to separate employees from 1099 subcontractors.

-

A company may wish to use the EBMS Time Track tools for time and attendance without creating timecards. Review Clock In/Out without Timecards for instructions to use EBMS time clocks without payroll.

Configure Labor for Time and Task Entry

Complete the following steps to configure the EBMS labor module to record labor using Tasks, MyTime, or Time Track without processing payroll.

-

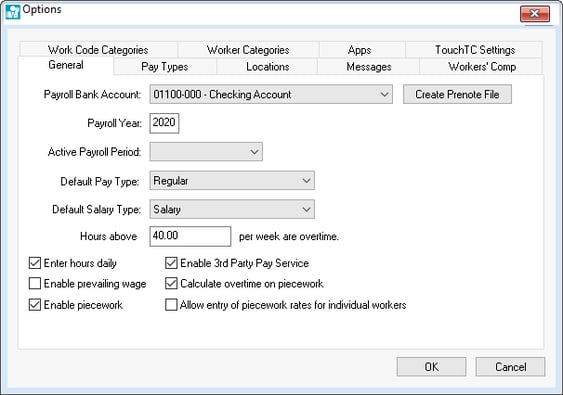

Set up the following Labor > Labor Options > General tab settings:

-

Set the Payroll Year.

-

The Default Pay Type and the Default Salary Type cannot be blank. Populate these fields if they are not already set. Pay types are used to identify the type of pay added to a timecard and the type of pay listed on the worker’s history and pay stub. Review Pay Types to create pay types.

-

Enable the Enter hours daily and the Enable 3rd Party Pay Service options.

-

The other options such as Payroll Bank Account are not required until payroll is being processed.

-

-

Open the worker list by selecting Labor > Workers from the main EBMS menu.

-

Select the worker's root folder by selecting the Workers category root folder, right-clicking on the category folder, and selecting Edit Defaults as shown below.

-

Click on the worker default Pay tab and set the Frequency based on the estimated time until the recorded time will be used for internal payroll, 3rd party payroll, or 1099 subcontractors.

Set the Frequency option to the payroll period currently used within the company. This option may require many open periods for a weekly or bi-weekly payroll.

Consider the following options if the company does not plan to use the EBMS Labor module to create payroll data in the near future:

-

Set the Frequency to Annually if the time data will not be used within the current calendar year. Use a smaller pay period frequency if this time may be used for payroll within the current calendar year.

-

Select Semi-Annually if the estimated time is a half year.

-

Use Quarterly or another shorter pay period for the Frequency if the estimated time is less than a half year. The target time frame to start using the EBMS labor module to process payroll or to export data to a 3rd party payroll processor should normally be targeted at the end of a calendar quarter.

-

-

Filter down this Frequency setting to all existing workers by right-clicking on the field and selecting Filter Down from the context menu and following the instructions. Filter down to all subfolders. Review Change Defaults, Filter Down Data and Globally Change Data for instructions to set this option for all workers within the current catalog.

-

Set the Method option to Payroll Service and repeat the filter down step to set the Method setting for all existing workers. Filter down to all subfolders.

-

Disable the Is subject to minimum wage option since wage calculations are not needed. Filter down to all workers and subfolders.

-

Possibly blank the pay rates, both Hourly Pay and Salary Pay, if the labor cost transactions are not used to track labor costs in jobs or other reports. Do not blank rates if they are used within EBMS for reporting purposes. Filter down to all workers and subfolders.

EBMS will create payroll payable for any transactions that contain pay rates. A journal entry may be required to reverse any accounting labor pay transactions created during the payroll process. -

Set up basic pay types. There is need to add advanced pay types. Use the default pay types delivered with EBMS if they already exist. Add a Default Work Code if a common work code is being used. Review Setting Worker Defaults to set pay types and work code defaults. Filter down to all workers and subfolders if any new pay types have been added.

-

All Worker Taxes and Company Taxes lists should be blank, or tax settings should be disabled. Filter down each tax or deduction that has been disabled.

-

Create worker categories to separate workers that are within different locations, departments, or groups. Create a separate category for 1099 subcontractors if they are being added to the worker list. Review Workers > Adding and Deleting Worker Categories for instructions on creating worker sub-folders.

-

Create worker records including worker name and contact info for any person (including subcontractors) entering time into EBMS, if they are not entered already. Review Entering New Workers for instructions to enter worker records.

-

Set the largest pay period based on the amount of time that payroll will not be processed. The Pay Period end date should be the calendar year or quarter considering the Frequency setting filtered down to the worker records in the previous step.

Review Opening New Pay Period for additional instructions on this step.

Use Time and Task Entry Tools

Review Time and Attendance Overview for information on time-tracking tools.

Review Tasks Overview or MyTime Overview for information on work order and other task tools available including advanced tools like Flag Pay, Job Costing, Piecework Pay, dispatch tools, and Prevailing Wages.

Process Labor at End of Pay Period

-

Process payroll by completing the payroll steps by:

-

Calculating Taxes: Review Processing Payroll > Calculating Taxes for steps, even though tax settings are blank.

-

Process Payments: Review Processing Payroll > Process Worker Payments for steps.

-

Closing Pay Period: Review Processing Payroll > Closing Pay Periods to close this pay period.

-

Financial transactions are created when processing payroll, unless the pay rates equal zero. These General Ledger transactions consist of credits posted to payroll payable and debit transactions posted to the expense account set within the work code. These financial transactions may need to be reversed for accounting purposes. Review this process with the company accountant or CFO.

-

Review the following settings If payroll is being processed by the EBMS labor module for future pay periods or create a new annual, quarterly, or monthly pay period to repeat the labor collection process without payroll:

-

Verify the pay period Frequency within the Pay tab of all workers.

-

Verify the Pay tab > Method for each worker.

-

Enable the Is subject to minimum wage option if payroll is being processed. This is an important payroll processing option if EBMS payroll or 3rd party payroll is processed in EBMS.

-

Set or verify Pay tab > Pay Rates for all workers.

-

Set Worker Taxes and Company Taxes for all workers.