Sales Tax and Use Tax Overview

Sales Tax Definition

Sales tax is a tax that is levied by numerous state governments at the time of sale. This tax is collected from the buyer by the seller at the time certain goods or services are sold. Sales tax is normally paid by the consumer, which exempts a seller from levying sales tax when product is being sold to a reseller.

Use Tax Definition

Use tax is essentially the same as a sales tax, but it is applied when product is consumed rather than sold. Use tax applies when a consumer purchases product but did not pay sales tax for various reasons, such as:

-

Product was purchased without sales tax because it was purchased outside of the purchaser's state of residence.

-

Product was purchased by a reseller without sales tax but was consumed rather than resold to a customer that included sales tax.

-

Product was purchased without sales tax for a job that was billed to the consumer without sales tax. This is common when a customer is billed for construction and other nontaxable services that include taxable parts or materials. Use tax must be paid based on the cost of the taxable products used within a non-taxable job.

Scenario 1: A distribution company in Pennsylvania purchases office supplies at a store in New Jersey and does not pay sales tax. The secretary enters this purchase within EBMS, using the items consumed use tax method. This process calculates the use tax at 6 percent, adds it to the company’s monthly Pennsylvania sales tax payment, and records the details for any future tax audit. This defined process meets the state tax requirements for this often-missed use tax payment without increasing paperwork for the bookkeeper. The financial manager has the confidence that use tax is properly calculated, recorded, and paid.

Scenario 2: An equipment sales and service company purchases parts to resell to the consumer. Parts and service projects are charged sales tax when the customer is billed. At times, these parts are used to repair internal equipment such as a lift truck or generator. The service manager attaches the work order for the internal equipment to an internal “customer” account to manage inventory and costs. This process allows the technician to record parts on the internal work order using the same steps as a repair for a customer. The internal sales invoice not only processes costs and inventory but calculates use tax even though the internal invoice is zero. This method of recording the consumption of parts for company equipment meets state tax requirements as well as generally accepted accounting principles.

Scenario 3: A building supply center in Maryland purchases various materials for metal buildings sold in Maryland, Pennsylvania, and West Virginia. Most product is purchased without sales tax by this building supply center since customers are charged sales tax when product is sold. Metal buildings are built at the customer’s location and do not include sales tax. The builder is required to pay use tax on the materials used to construct the building. The use tax process calculates and records tax for the jobs within all three states, includes use tax for internally consumed goods, and calculates sales tax for product sold to customers. EBMS records, reports, and processes the sales and use tax payments that meets the needs of each tax jurisdiction without the hassle and manual bookwork required by many ERP systems. They added TaxJar to remove rate setting and tax filing requirements.

Video: Use Tax ERP Support Training

Review Configure Use Tax for steps to enable Use Tax within EBMS.

Tax Calculation Criteria

EBMS contains intelligent sales and use tax tools to calculate the proper tax based on various criteria such as the store location, shipping method and location, product groups, jobs, and other settings important to tax calculation.

Sales and use tax rates are applied to invoices and items using an intelligent process rather than requiring the user to manually associate rates to customers, jurisdictions, or items. EBMS associates one or more tax rates to a sales invoice. The tax rate(s) are determined within an invoice using the following criteria:

-

Shipping Address: The sales tax rate will be determined by the shipping address within a sales invoice's Ship To tab only if the Ship Via setting within the invoice indicates that the product is being shipped. The sales tax for all orders that contains a Shipping Method with a rate type of Customer Pickup is calculated using the company address (see explanation below). Go to Sales > Options, select a Shipping Method by clicking on the Properties button, and review the Rate Type setting. See the Calculating and Comparing Freight Charges section for more details on the Ship Via setting.

The city, state, and country taxes are derived directly from the shipping address entries. The county is determined from the county setting within the zip code table. Review System Options to view or change the zip code table. -

Company Location: All invoices that are not being shipped will be charged the sales tax rate derived from the company address. Multiple company locations or divisions can be setup within a single EBMS data set. Review the Company Profiles section of the main documentation to view or change the company address. Review Multiple Locations for instructions on how to set up multiple sales locations for the same company.

-

Customer's Tax Exemption settings: A customer's terms can be set to be exempt from sales tax. Review Configuring a Tax Exempt Customer for details.

-

Product groups or categories may affect tax rates: Multiple EBMS Inventory Tax Groups are created to facilitate multiple tax rates or exemption rules based on specific product groups. This advanced option allows the software to handle very complex sales tax requirements. Review the Inventory Tax Groups section for more details.

-

Job site and use tax settings: Most use tax settings are configured within a job. Review Configuring Use Tax for scenarios, setup, and details about use tax.

-

Use tax vs sales tax setting on sales invoice: Review Paying Use Tax on Items Consumed for instructions to calculate use tax on items consumed by the company.

-

User-defined rate: The sales tax rate can be manually set within an invoice. Review Changing the Tax Rates Within a Sales Invoice for more details.

Configure Taxes

EBMS includes robust tools to calculate and manage various sales taxes using one of the following options:

-

The TaxJar integration subscription service includes the following features:

-

SmartCalcs: Cloud-based sales tax rates to remove all the hassle of configuring sales tax rates. Review TaxJar Overview for details and costs for this convenient service.

-

TaxJar® Report: The TaxJar Reports provide automated sales tax Reports that break down your sales data by jurisdiction, which simplifies the process of filing manually.

-

AutoFile: This optional service automatically submits tax returns to the states that the company is registered to ensure you never miss a due date. Review AutoFile for details.

-

Set up tax rates within the EBMS software: Sales and use tax rate tables for each country, state, county, or city must be configured. Review Establishing New Tax Rates for rate setup instructions. Only the tax tables that are collected by the company should be entered into the system. For example, multiple tax rates (state, county, or city) may apply to your business. The software will determine which tax tables are applicable based on the shipping address (if items are shipped) or the company address for orders that are not shipped. Review Changing Rates and Other Settings for steps to enter tax rate changes based on a date.

EBMS also contains the tools to manage and calculated more advanced taxes:

-

VAT or Luxury Taxes: Review Luxury, VAT, Sales Tax Minimums and Maximums for more details on minimum and maximum settings.

-

Fuel taxes: Review Calculating Fuel Taxes for more details on setting dollar-based taxes instead of percentage rates.

It is important to configure EBMS properly to match the sales tax laws of each state. A company can dramatically increase their chances of audit, fines and repayment if these settings are ignored. Review Origin vs Destination Sales Tax for configuration details.

Tax Payments

There are two methods available to handle paying collected sales tax payments to the sales tax agency:

-

TaxJar sales tax service: Review the section on TaxJar AutoFile to review instructions to allow TaxJar to file sales tax returns.

-

Using EBMS to manage sales tax payments: Review Paying Sales and Use Tax for instructions to calculate the amount of tax payable to the tax agency and generate payment.

See Reviewing Tax History to view the sales tax history for a specific tax rate or jurisdiction.

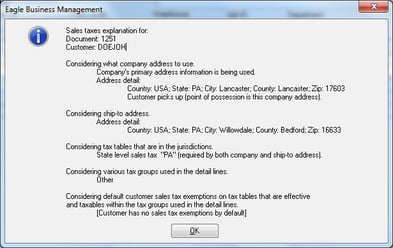

The EBMS software will explain the process used to calculate sales tax because of the varied factors involved in sales tax calculation. This explanation can be accessed by clicking on the View > Sales Tax Explanation from the sales invoice menu as shown below. The first dialog is if the EBMS sales tax process is used, and the 2nd is the data sent to TaxJar.

Note: It is very important to set up the sales tax rate tables properly or configuring the TaxJar service before proceeding with the sales invoice processing within EBMS.